Asian demand returns for gold

When prices rise overnight, or they rise into London’s morning fix we know that China and possibly India are buying again.

This week has been a tale of diversity, with gold close to challenging new high ground, but silver lagging, evident in our headline chart. In European trade this morning, gold was $2466, up $80 from last Friday’s close, and Silver at $28.93 was up 95 cents. Looking at the relationship between price and open interest, their performance on Comex has been different as well:

Note how gold’s Open Interest has declined remarkably while the price has held close to all-time highs. This indicates impressive underlying strength. The relationship in silver is more normal, with both the price and OI trending in the same direction. In both cases, speculator interest appears average, as opposed to excessive, indicating that there is room for buyer demand to drive prices higher before a consolidation is due. In the case of gold, this would be into new highs over $2500 spot (the active Comex contract is at $2507 already), and silver should have significant catch-up potential indicated by a gold/silver ratio at 85:

The chart doesn’t tell us much other than to remind us just how far from being valued as money silver has become. In these times of growing credit risk, physical silver looks badly out of kilter, and the relationship should already be reflecting its return to a role as the poor man’s gold.

Overnight demand for gold has been in evidence this week, draining already diminished western gold liquidity. We see this when prices rise overnight and when they firm up ahead of London’s morning fix. It should be noted that some of this demand is speculative, with aggressive positions being adopted in Shanghai futures. That has the potential to create some volatility, but clearly the gold price is being set not in London or Comex but in Shanghai.

It is Chinese, and also Indian demand through Dubai to which we must pay attention. Interestingly, when India recently cut the tax on imported gold to 5%, the price discount in Mumbai was replaced with a small premium.

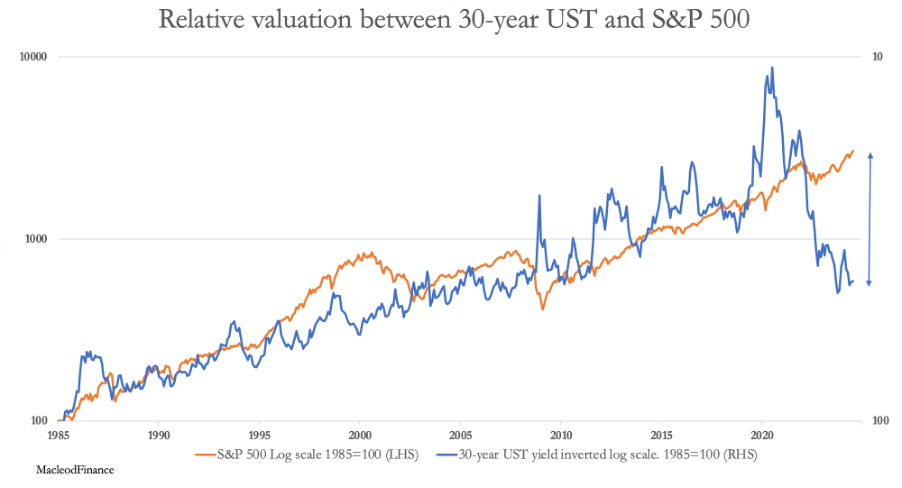

There are also tectonic plates shifting in the background. There is more evidence that global equities have entered a bear market, and we could see further substantial falls in the coming weeks. At the same time, US Treasury yields have declined sharply, partly due to growing confidence that the Fed funds rate will be reduced in September. Additionally, poor earnings from top tech stocks and growing evidence of a faltering US economy are reducing the valuation gap between bonds and equities, indicated by the double-headed arrow in the chart below.

This is probably the most excessive relative overvaluation of equities in US financial history, certainly in the last forty years, even greater than during the dot-com bubble, following which the S&P halved.

In the past, such as in 2008—2009 gold was initially seen as a source of funds in an equity market crisis. But physical gold has already gone to China, with ETF holdings having been sold down over the last three years. This time, bitcoin and other cryptos appear to be a likely source of funds if markets crash.

And finally, we cannot ignore developments in the Middle East. Israel assassinating a Hamas leader in Tehran and increasing attacks from Hezbollah are major escallations. A deteriorating situation seems likely to flare up into a full-scale war. It could be the only way an increasingly desperate Israel can persuade America and NATO to back her against Iran.

If the Bullion banks are not able to make physical delivery on precious metals being demanded for physical delivery. Would they resort to revising the price of these delivery higher to reduce the amount of physical metal to be delivered?

Can't help but think that the realisation that " Silver Is Money " , always has been & always will be - despite it having been de-standardised by the usual suspects yonks ago - that this will become all too apparent to one & all as soon as the global financial system's edifice starts to crumble & disintegrate before our very eye's . If Silver comes out of the ground at a 7 : 1 ratio compared with Gold & given it's multiple use's and severe scarcity - I can see it being worth vastly more than most think is possible .

Per the above & thinking back to the vast amount of ' United ' & ' American ' airline stocks which were found to have been shorted immediately prior to ' 9 : 11 ' - am just wondering who or what entity it is that has just placed these $200 x Dollar Silver Call's that have been sitting at around 4,812 Open interest for over a week or so now and whether it is they or someone new who has only just added another 1,300 Call's ( taking O.I. now up to - 6,812 ) .....Said options are due to expire on the 28th of August , ' SO ' question is what is it that they expect ( Or Know ..?? ) is going to take place between then & now , as will cause Silver to rise so dramatically and produce such a massive ' Pay Day ' for those concerned ..etc .