Gold and silver surge higher

Apologies: Reposting because there was a chart missing (I was in a hotel with lousy internet!)

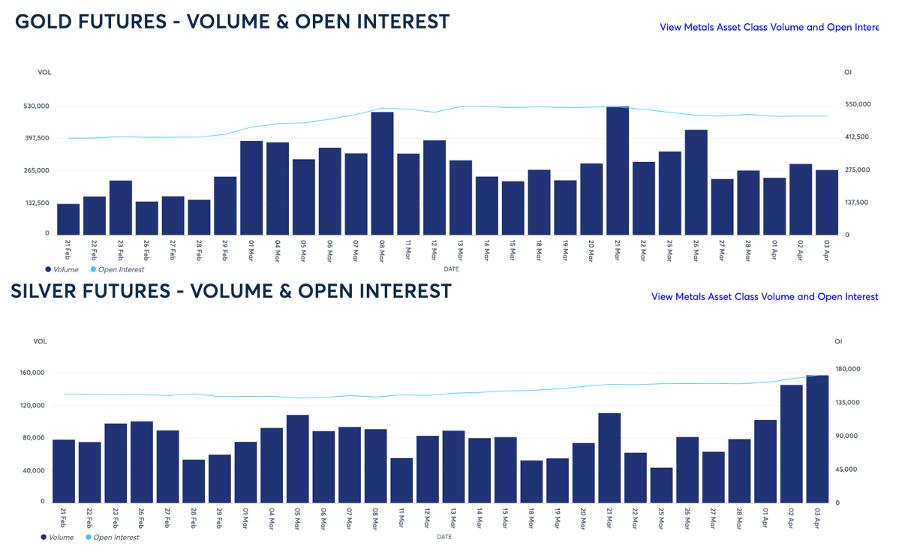

Gold and silver continued their run higher, defying predictions of profit-taking. From last Thursday’s close (Friday was Easter and market were closed), gold rose $50 to $2280 in early European trade this morning, after flirting with $2300. That’s a rise of $300 since St Valentine’s Day. And silver traded at $26.60, up nearly 19% over the same time period having traded as high as $27.30. Comex volumes in the silver contract were exceptionally high, but relatively subdued in gold. These are shown next.

Comex gold deliveries continue apace, less so in silver, but more now in gold. 97 silver contracts representing 485,000 ounces were stood for delivery in silver in just four trading days, but in gold 7,689 contracts (768,900 ounces) were stood for delivery.

The lack of volume in the gold contract together with the recent decline in Open Interest as the price rose strongly into new high ground is mystifying traders. They don’t know who is buying: it certainly isn’t the hedge funds. Gold’s performance smacks of a massive bear squeeze on one or more bullion banks. How did it come about?

Ultimately, bullion banks have a problem understanding gold, because they think that the relationship between dollars and gold is driven by relative interest rates. But there has been a growing realisation that US interest rates will remain high for longer, which according to paper traders should lead to lower gold prices. But the reverse is happening. In fact, the chart of the 10-yearTreasury yield is looking almost as bullish as that of gold:

The insert shows the unquestionably bullish position in detail. Compare this with gold before it took off:

Again, we see the price rising above a rising 55-day moving average, and above a rising long-term MA. Why are gold and bond yields rising together?

The answer can only be that the big, mainly Asian wealth funds look at the US Government’s finances and see deep trouble. The only way the US Government can satisfy its voracious appetite for debt is at higher interest rates and bond yields. And if interest rates go higher, they will crash financial markets, bring about commercial property and corporate insolvencies, and threaten the entire banking system. In short, foreigners are desperate to reduce their exposure to dollar credit as much as possible and the only way to do that is to buy real money without counterparty risk, which is gold.

To confuse traders, there is liquidity in smaller gold transactions. You can still buy kilo bars and coin. But if, for example, on the London market you are committed to deliver 400-ounce bars in quantity by next Tuesday, they are simply not available. I guess that’s where the problem lies.

If this squeeze on one or more bullion banks eases, then the price should too. But the problem will not be resolved: the evidence is that foreigners are increasingly turning their backs on the fiat dollar and the entire credit system.

Thank you Alasdair, as always, your insight and analysis are spot on. I am so fortunate to have become a member of your Substack group. I am not a clever man but listening to you on various podcasts and now reading your works I have an understanding of what gold is, how it works and its role my future. I can confirm that your goals when setting up this Substack have been achieved, at least in my personal case haha. The problem I am finding is that many many people that I know , care about and converse with just close their eyes and shut their ears to what is happening around them, they just say “ I cannot do anything about it”. I say to them “I agree, you cannot do anything about it, BUT, you can prepare for it”. Once again, thank you for sharing your wisdom

Cedric

You are right that silver is still recognised as money across much of Asia, and therefore as confidence in western fiat diminishes that a degree of value for monetary purposes returns. This is why generally speaking when gold's value increases, silver's tends to twice as fast.