Powell spills the beans

At Jackson Hole, Jay Powell finally admitted that targeting inflation is over and cutting interest rates to support the economy is the new policy. He signalled that a weak dollar doesn’t matter.

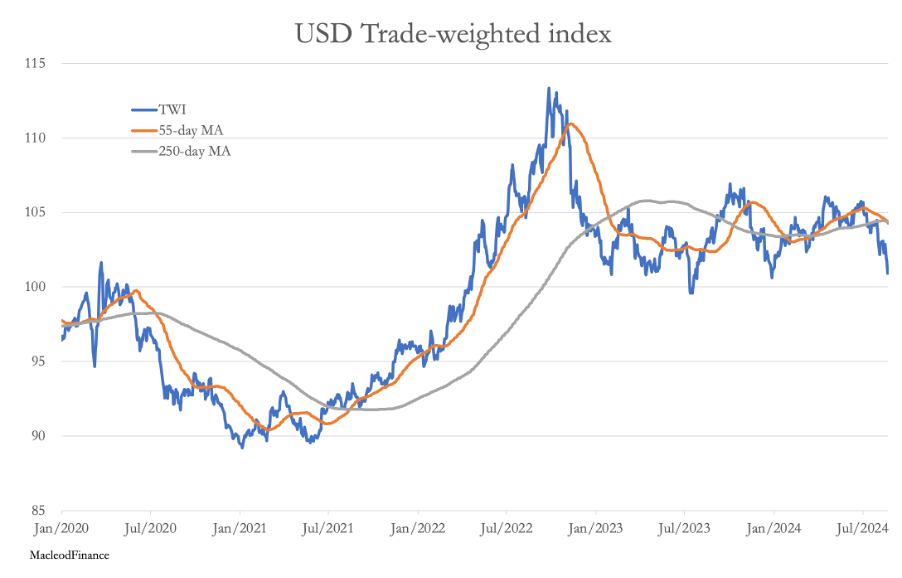

The death cross on the dollar’s trade-weighted index (shown above) anticipated Powell’s speech, falling 1.6% in the last week. When it breaks the 100 level, a target of 90 is in play. But after its recent sharp falls, a countertrend rally is likely first, as short-term traders short of the dollar take profits. And they could be badly squeezed before the dollar’s downtrend resumes, particularly with the other currencies in the basket having their own troubles.

Gold is on the other side of the dollar trade, and just as the dollar’s TWI looks very bearish, gold’s chart is correspondingly bullish.

But here again, a brief pullback might be in order if a temporary recovery in the dollar encourages hedge funds to take profits on their dollar bear positions, and for the Swap category on Comex to mark gold prices down in an attempt to trigger hedge fund stops.

All this is very short-term and should be of little interest to those who want to get out of dollars and sleep at night. For stackers, if this pullback happens it could be the last decent chance to buy gold under $2500. Of more interest is what last week’s Commitment of Traders figures told us.

Keep reading with a 7-day free trial

Subscribe to MacleodFinance Substack to keep reading this post and get 7 days of free access to the full post archives.