Summer’s pause is ending

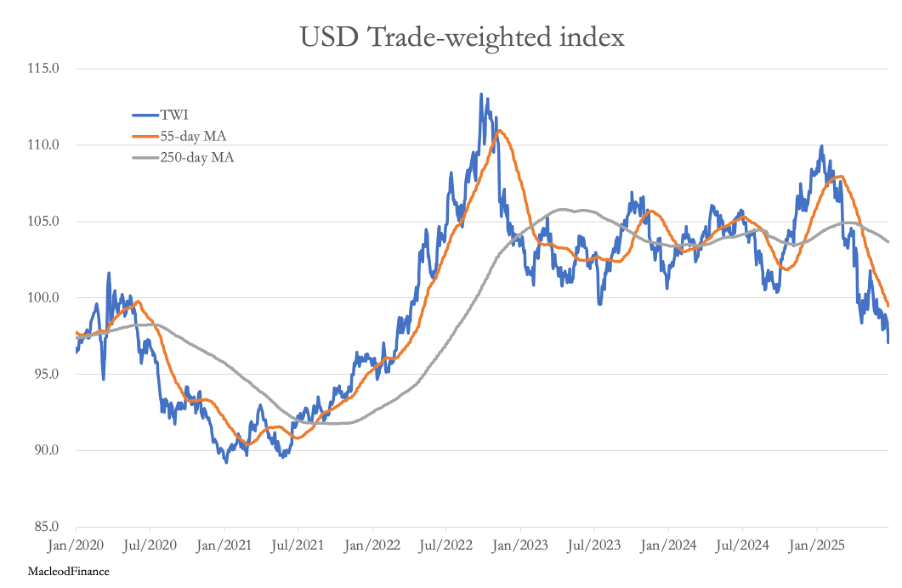

Foreign holders of $39.6 trillion have lost 13% on their dollars since January according to the TWI. It more than wipes out any gains made on underlying assets.

The chart of the dollar’s trade weighted index is dismal, to say the least.

It is not helped by the president calling for a weaker dollar and putting pressure on the Fed to reduce interest rates. But the yield on the 10-year treasury note points to higher, not lower yields.

It’s not quite a golden cross yet pointing to higher yields because the yield is just under the moving averages, which are both rising. A convincing rise above 4.4% is all that’s required.

An understanding of credit tells you that when there is greater risk associated with dollars the risk premium rises relative to alternative currencies. Foreigners exposed to dollars having sold their own their own currencies to buy them are making precisely this assessment.

You should forget optimist talk of the Fed cutting interest rates and that US bond yields will decline. For foreigners the mathematics of risk are what counts, and the value of the dollar relative to their currencies is what matters. President Trump, his tariffs, his borrowing plans, and his pure capriciousness together inform foreigners, increasingly concerned about their exposure to dollars and dollar-denominated investments.

Keep reading with a 7-day free trial

Subscribe to MacleodFinance Substack to keep reading this post and get 7 days of free access to the full post archives.