Open interest in the Comex gold contract has collapsed dramatically in recent days.

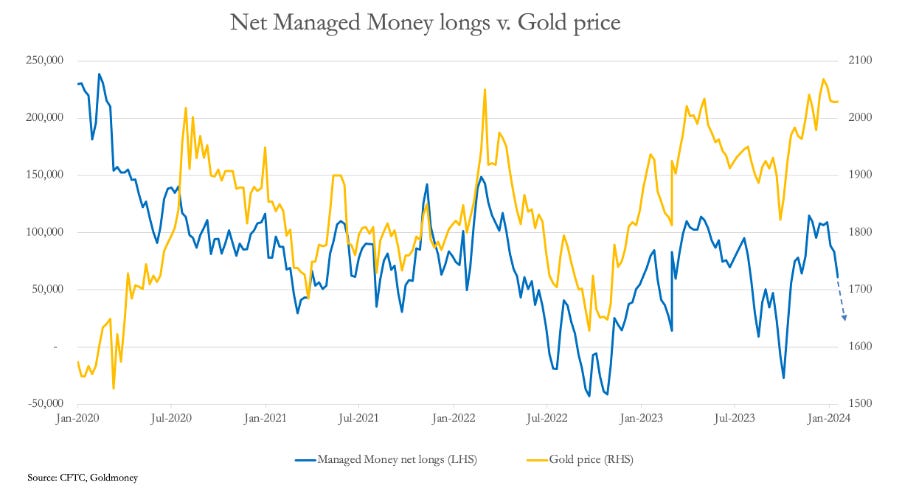

This has been reflected in hedge funds reducing their positions.

On the last Commitment of Traders figures, net longs were 61,033. That was on 23 January. With the collapse in Open Interest, I suspect that today the figure is closer to 40,000 (see dotted arrow).

Meanwhile, Other Reporteds net longs have increased to 108,441 on 23 January.

It is this category which I believe stands for delivery, taking out 515,400 ounces in January so far. Clearly, the character of this market hs changed.

Conclusion

The level of speculative interest in the gold contract is dying. The ability of the Swaps to trigger stop-losses is being compromised. In other words, liquidity in this contract is dropping, likely to make it more volatile. When the uptrend resumes, the price move should be spectacular. But in the very short-term, don’t be surprised if in thin markets gold dips towards $1950. But bear in mind that the real money will be accumulating every ounce it can get its hands on!