Why silver prices will rise

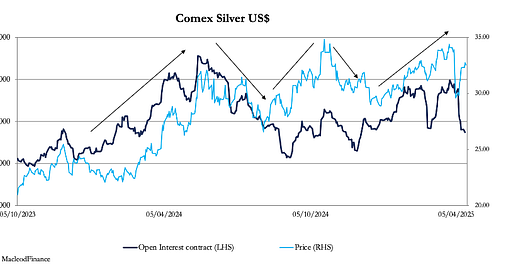

In this article, we detail the reasons behind silver’s disappointing performance and why they are now changing. China’s export and policies are now driving the price higher.

Introduction

Relative to its supply, silver is probably the most demanded industrial metal on the planet aside from the rare earth groups. It is now valued exclusively as an industrial metal, and its price has been driven more by global economic and not monetary demand, which is why it appears to have decoupled from gold.

Trump’s tariff policies have undoubtedly damaged the global economic outlook. Perhaps this is why the price of silver, along with that of copper was smashed in the wake of Trump’s so-called liberation day falling 15% in only four trading sessions. Until then, silver had been gaining ground in the belief that relatively non-cyclical demand against a background of supply deficiency would see prices continue to rise.

There is nothing in the price for its role as money, which is shown by a gold silver ratio in excess of 100 times. That in itself is an aberration likely to correct.

Keep reading with a 7-day free trial

Subscribe to MacleodFinance Substack to keep reading this post and get 7 days of free access to the full post archives.